“Hummingbird” transfers are urgent money transfers in cash from Sberbank of Russia. Transfers from BPS-Sberbank. Instantly or without commission? Money transfers BLIZKO

Alfa Bank Belagroprombank Belarusbank BelVEB Belgazprombank Belinvestbank BNB-Bank BPS-Sberbank BSB Bank BTA Bank VTB (Belarus) Idea Bank Moscow-Minsk MTBank Paritetbank Priorbank Solution RRB-Bank Technobank

Alfabank transfers funds from the card account of one person to the card account of another person without commissions and fees. This condition applies to transfers via Internet banking and mobile banking. Transferring money from card to card via an ATM or information kiosk is not possible.

When transferring funds from the card account of one person to the card account of another person, Belagroprombank deducts a commission from the sender in the amount of 1.5% of the transfer amount, but not less than 0.2 BYN per transaction. The commission size is the same and applies to all transfer methods: Internet banking, m-banking, information kiosk.

When transferring funds from the card account of one person to the card account of another person, Belarusbank deducts a commission from the sender in the amount of 1.5% of the transfer amount. The commission amount is the same and applies to all transfer methods: Internet banking, m-banking, ATM/info kiosk.

BelVEB Bank carries out transfers of funds from the card account of one person to the card account of another person without commissions and fees. This condition applies to transfers via Internet banking and mobile banking. Transferring money from card to card via an ATM or information kiosk is not possible.

Belgazprombank transfers funds from the card account of one person to the card account of another person without commissions and fees. This condition applies to all transfer methods: Internet banking, m-banking, ATM/info kiosk.

Belinvestbank transfers funds from the card account of one person to the card account of another person through Internet banking and m-banking without commissions and fees. In case of transfer through an ATM or information kiosk, a commission of 1.5% of the transfer amount is charged, but not less than 2BYN per transaction.

BNB-Bank transfers funds from the card account of one person to the card account of another person without commissions and fees. This condition applies to transfers via Internet banking and mobile banking. Transferring money from card to card via an ATM or information kiosk is not possible.

When transferring funds from the card account of one person to the card account of another person, BPS-Sberbank deducts a commission from the sender in the amount of 2.5% of the transfer amount, but not less than 0.5 BYN and not more than 15 BYN per transaction. The commission size is the same and applies to all transfer methods: Internet banking, m-banking, information kiosk.

BSB Bank carries out transfers of funds from the card account of one person to the card account of another person without commissions and fees. This condition applies to transfers via Internet banking and mobile banking. Transferring money from card to card via an ATM or information kiosk is not possible.

BTA Bank carries out transfers of funds from the card account of one person to the card account of another person without commissions and fees. This condition applies to transfers via Internet banking and mobile banking. Transferring money from card to card via an ATM or information kiosk is not possible.1

When transferring funds from the card account of one person to the card account of another person, VTB Bank deducts a commission from the sender in the amount of a fixed payment - 0.15 BYN. The commission amount is the same and applies to all transfer methods: Internet banking, m-banking, ATM/info kiosk.

Idea Bank carries out transfers of funds from the card account of one person to the card account of another person without commissions and fees. This condition applies to transfers via Internet banking and mobile banking. Transferring money from card to card via an ATM or information kiosk is not possible.

When transferring funds from the card account of one person to the card account of another person, Moscow-Minsk Bank deducts a commission from the sender in the amount of 1% of the transfer amount + 0.14 BYN. The commission amount is the same and is valid for transfers via Internet banking and m-banking. Transferring money through an ATM/kiosk is not possible.

MTBank carries out transfers of funds from the card account of one person to the card account of another person only through Internet banking or the online service perevod.mtbank.by. There are no fees for this transaction.

Parity Bank carries out transfers of funds from the card account of one person to the card account of another person without commissions and fees. This condition applies to transfers via Internet banking and mobile banking. Transferring money from card to card via an ATM or information kiosk is not possible.

When transferring funds from the card account of one person to the card account of another person, VTB Bank deducts a commission from the sender in the amount of a fixed payment - 0.5 BYN. The commission amount is the same and applies to all transfer methods: Internet banking, m-banking, ATM/info kiosk.

Transfer of funds from the card account of one person to the card account of another person via Internet banking or m-banking Bank Solution carries out commissions and fees. In case of transferring funds through an ATM/kiosk, a commission of 0.5% of the transfer amount is charged, but not more than 1BYN.

RRB-Bank carries out transfers of funds from the card account of one person to the card account of another person only through Internet banking. There is no fee for this service.

Technobank transfers funds from the card account of one person to the card account of another person without commissions and fees. This condition applies to transfers via Internet banking and mobile banking. Transferring money from card to card via an ATM or information kiosk is not possible.

The advantage of the modern banking system is its global nature, thanks to which clients can transfer funds not only within the country, but also to any bank in the world. Given that Belarus and Russia have friendly relations, their citizens may need to transfer funds. One such option is one that allows you to transfer money to Belarus through Sberbank, but customers are asking if this can be done through an online system.

About the possibility of transferring funds from Russia to Belarus through Sberbank

If clients want to send money to Belarus directly to a bank card in this country, they will be refused, because this simply cannot be done. Although Sberbank is present in Belarus, it is not possible to make a direct transfer to its card, and it is necessary to use international systems. As in other countries, funds can be transferred in cash or from an account, including using Internet banking.

Transferring money from a Sberbank card to Belarus is not a difficult undertaking if a person knows the recipient’s full name, his bank details and other official information. First, you need to take data from the recipient of the funds, which he has the right to request from his bank. All information can be transmitted via the Internet or by phone, after which the Russian must provide the details to the cashier or enter them in Internet banking.

Available methods

Even taking into account the fact that BPS-Sberbank, operating in Belarus, has been a subsidiary of the Russian Sberbank since 2009, the client is not spared the need to use international payment systems. There are several methods to transfer money from Russia to Belarus through Sberbank:

- cash transfer using the Kolibri system;

- MoneyGram;

- international transfers in cash or non-cash methods.

The first method, which involves using the Hummingbird system, allows you to send money without the need to open a new account with Sberbank. To send it, you can contact the company’s office directly and transfer the money to the cashier or consultant. The transfer procedure will be completed within an hour, although usually the money is transferred earlier. A special feature is that both the sender and the recipient pay a commission of 1% of the transfer amount.

The international MoneyGram system makes it possible to send money, which will be received by the recipient within 10 minutes, however, it is impossible to transfer money from a Sberbank card. But the percentage in this case is quite high, since the funds are transferred in currency, usually dollars. For an amount up to $100, the fees will be 2%, and for a larger amount the percentage will be higher, for example, from $100 to $300 you will need to pay an additional 3%.

International transfers in cash and by non-cash method are carried out within a period of up to two working days, while the money will be sent within 24 hours if the transfer is made to a card or account. You must pay 2% for the transaction if it is made in rubles; when sending currency, you will need to overpay 1% of the amount. Previously, Sberbank offered its clients the “Blitz” service, which later became known as “Hummingbird”.

Important! At the moment, this is one of the fastest ways, because money is available within 10-20 minutes after sending. Both rubles and dollars can be sent from euros. The main thing is that a commission of 2% is paid for a transaction in national currency and 1% if we are talking about transfers in foreign funds.

Is it possible to transfer money through Sberbank Online

There are no problems when sending money between clients of Russian banks, and this task can be completed through Sberbank Online. But the situation changes when money needs to be sent abroad, in particular to Belarus. The fact that there is a subsidiary of Sberbank in this country does not negate the fact that these are different legal entities located in different countries. Therefore, it is impossible to transfer money to Belarus through Sberbank Online, and you need to use other international systems for this.

They, in turn, only require a visit to the branch, and, depending on the system, different lists of documents will be required. For example, the easiest way would be to create a translation of “Hummingbird”, which can be sent to Belarus and Kazakhstan. Apart from the passport and full name of the recipient, no data is required. A SWIFT transfer will be less convenient, since, in addition to the passport, you need to know the name of the bank where the recipient will receive the money, as well as its SWIFT code. In addition, you must also provide the recipient's address or passport details.

MoneyGram, which requires a higher commission, will require a smaller list of data. So, the client will only get by with his own passport and the name and surname of the recipient, written in Latin letters. But it will be possible to receive a transfer from abroad through Internet banking, if the company allows it. Then you need to go to the payments and transfers section, and then enter the required transaction details.

Alternative options

In addition to official banks, there are no less legal methods, which, in particular, are payment systems. Of these, the most international is WebMoney, which operates in most countries of the world, and if a client replenishes an account and then sends funds to another user of the system, the operation will take place without any codes or additional data.

The problem is that you first need to enter personal data into your account and confirm it using your passport data. But the verification is quick, and to make a transfer you only need to know the user’s wallet number; new ones are opened instantly and do not require additional confirmation. In addition, you can link a card from any bank to your account and subsequently immediately transfer money directly to it. The transfer fee is set at 2-3% of the amount, which is quite tolerable compared to other options.

If intrabank systems and WebMoney do not suit the client, he can use additional transfer systems, one of the most convenient is Western Union. Almost every bank in the world is connected to it, and Belarusian institutions are no exception. To work with it, you do not need to open an additional account, and the funds reach the recipient within a few minutes after sending.

The commission for this method will be a maximum of 1.7%, and it depends on the size of the transaction, as well as the type of currency. To receive a transfer, the receiving party needs to present a passport and also fill out a special form. It indicates the transaction number, its amount and other information, so the method is quite simple and reliable.

Conclusion

There are several ways to transfer funds from Russia to Belarus, but you must definitely come to the Sberbank office, since such a transaction cannot be performed through its online system. A person can choose several systems and ways of transferring funds, which differ in commission and deadlines for completing the task. At the same time, there is a transfer that works only in subsidiary banks of Belarus and Kazakhstan - “Hummingbird”, it allows you to receive money in 10 minutes and even credit it to your card via Internet banking.

We check the quality of service in Belarusian banks. Today we will test transfers to the card BPS-Sberbank. Let's find out how to transfer money instantly, and how without commission.

First, we call the bank’s contact center.

- Good afternoon. My name is Alina. How can I help you?

- Hello. I need to transfer money to your bank card. How can i do this?

— You want to transfer from a card of some other bank, right?

— I have 2 translations. One transfer from a card of another bank to your card, and the second - from my BPS-Sberbank card to another BPS-Sberbank card.

— In this case, if you use our bank’s Internet banking, you can transfer funds remotely in your personal account. If you have a salary package, or for personal purposes you signed up for a “Classic” or “Status” service package, or you have a ComPass card, then there are several options for transferring funds without any commissions. Maybe you know what kind of card you have?

A few minutes later, we found out that I had the most ordinary card, which means that for a transfer to another bank client, they would still charge me a commission - 1.8% of the amount.

— This is a regular debit card, not included in the package of services, so a commission will be charged - this is 2BYN, if to our bank card,- the specialist explained.

— What if it’s through online banking?

—Yes, this is if through Internet banking. The card number and expiration date of the recipient's card are indicated there.

- Can I give you a phone number?

-Yes, you can also use a phone number if a client of our bank...

— What if from a card of another bank?

—If you transfer funds from a card of another bank, you can also do it remotely, without leaving your home, through the ERIP system. It indicates either the contract number or the account number in the formatIBAN This will be without any commissions.

— Clear. How fast?

— As soon as the money is credited to our bank, the funds are immediately credited to the account. As a rule, no later than the next business day.

- So not instantly?

- No, not instant translation.

— Isn’t it possible to instantly transfer to your bank card?

— If you use the information kiosk. In this case, the recipient’s card number is indicated, it is possible from a card of another bank, or in cash. This will be an instant card top-up without commissions.

The first transfer is from a card of another bank to a BPS-Sberbank card

On the advice of a specialist, we used the ERIP system.

The transfer was commission-free; we only needed to indicate the account number, which can be found in the Internet bank.

Despite the fact that the contact center specialist said that the transfer was not instantaneous, the money arrived on the card very quickly. I think we were very lucky.

It should be noted that the contact center specialist spoke in some detail about translations.

However, for transferring from a card of another bank, I was offered only one “non-instant” option - the ERIP system. But that's not true.

In fact, BPS-Sberbank has its own transfer system "Translate for me", the money should arrive instantly, however, a 1.8% commission will be charged for such a transfer, and only Mastercard and Maestro cards can be used for transfers.

Second experiment - transfer between BPS-Sberbank cards

For the second transfer, the specialist advised using transfers in the Internet banking system with a commission.

In chapter "Catalog" choose “Transfer to a private person”.

You can transfer money either by card number or by phone number. I used the second option. The system automatically found the recipient, so all I had to do was check the name and card number.

All that remains is to confirm the translation of the SMS. The money appeared on the recipient’s balance at that very moment!

Personal opinion of the correspondent

The consultation turned out to be incomplete, the girl suggested using the ERIP system and transfers in the Internet bank for transfers, but did not tell me about the “Transfer to me” transfer system!

Despite the fact that the transfer through the ERIP system is “not instant”, the money can only arrive the next day, it appeared on our balance sheet very quickly.

If you use the “Transfer to me” service, the transfer will be instant, but with a commission and only between Mastercard and Maestro cards.

As for intrabank transfers, they are also instant, the only pity is that you have to pay a commission. :(

Test result: 22.5 points out of 50 possible

| Evaluation criteria for the competition | BPS-Sberbank | |||

| By phone | Waiting time for a response from the Contact Center on the line | 1 point - 3.5 minutes 2 points - 3 minutes 3 points - 2 minutes 4 points - 1 minute 5 points - less than 30 seconds |

MAX 15 | 5 |

| Completeness of information received from the Contact Center |

. did they offer transfer options between cards - 5 points (if more than one) | 5 | ||

| . talked about each option in detail and named the commission - 5 points | 2,5 | |||

| . offering only offline transfer options (info kiosk or bank branch) - minus 2 points | 0 | |||

| Online transfers within one bank | Transfer speed from this bank's card | . 3 points - during the day |

MAX 40 | 10 |

| Cost of transfer from a card of this bank | . 0 points - any commission . 10 points - free |

0 | ||

| Online transfers from a card of another bank | Speed of transfer from a card of another bank | . 0 points - next day or longer . 3 points - during the day . 10 points - within half an hour |

10 | |

| Cost of transfer from a card of another bank | . 0 points - more than 1% . 5 points - less than or equal to 1% of the transfer amount . 10 points - free |

10 | ||

| Is it possible to make an online transfer between cards from different banks for all payment systems (Visa, Mastercard, BELKART) - minus 10 points (for the absence of one of the systems) | -20 | |||

| Maximum number of points | MAX 55 | 22,5 | ||

To which countries can I send an international transfer of “Hummingbird”?

International transfers through the Kolibri system can be sent to Belarus and Kazakhstan.

“Hummingbird” transfers are not sent to Ukraine.

You can send a transfer to another country through the transfer system.

Can I send a translation of “Hummingbird” to Ukraine?

“Hummingbird” and MoneyGram transfers are not sent to Ukraine.

It is possible to send a transfer to Ukraine (using the SWIFT system).

In which Sberbank offices can I make international “Hummingbird” transfers?

You can find the required Sberbank office on the page “ ” (“Select services” → “Hummingbird” international).

Can I send or receive a “Hummingbird” transfer at an ATM or in my Sberbank Online personal account?

You can perform all “Hummingbird” transfer operations only at Sberbank offices.

What is a transfer control number?

Each international “Hummingbird” transfer sent is assigned a control number (8 digits), knowledge of which by the recipient of the transfer is a prerequisite for its payment.

How quickly can I receive a transfer?

The international transfer “Hummingbird” becomes available for receipt 1 hour after it is sent.

Where can I get a translation of “Hummingbird” in Belarus and Kazakhstan?

You can get a translation:

- in Belarus – in the offices of BPS-Sberbank

- in Kazakhstan – in Sberbank offices

Features of receiving a transfer in Kazakhstan

You can receive a transfer at the Sberbank office (Kazakhstan) only upon presentation of a foreign passport and indicating the control number of the transfer.

What to do if the recipient cannot receive the transfer?

First of all, make sure that when making the transfer, the recipient’s details were correctly indicated - his full last name, first name and patronymic (if any). If you find an error in the recipient's full name, contact the Sberbank office where the transfer was sent (or any other office located in the city where the transfer was sent) and correct the transfer. The operation is free.

You can check the correctness of the recipient's details in the application you received when making the transfer.

If the recipient's details were entered correctly, make sure that the control number sent to the recipient is correct. If necessary, provide the control number to the recipient again.

In what cases and where can I correct the translation of “Hummingbird”?

The sender can make changes to the not yet received transfer regarding the recipient's last name and/or first name and/or patronymic. To do this, you must have your passport and the transfer control number (8 digits) assigned during its execution.

You can correct the transfer at the Sberbank office where the transfer was sent or at another Sberbank office located.

Can I cancel the transfer?

You can cancel a transfer that has not yet been received at the Sberbank office where the transfer was sent or at another Sberbank office located. To cancel, you must have your passport and the application issued when sending the transfer with the transfer control number (8 digits).

In what exceptional cases is it permissible to issue a “Kolibri” transfer to the recipient if the full name in the transfer details does not match the data in the recipient’s identity document?

Such exceptional cases include different spellings of the letters “E” or “E” and the letters “I” or “Y” in the transfer details and details of the recipient’s identity document, the same spelling of letters in Latin and Cyrillic (for example, “P” (lat. .) and “P” (Kyr.)), as well as the absence or presence of a space or hyphen in the full name details.

What to do if the control number of the “Hummingbird” transfer is lost?

A duplicate control number will not be issued. You can cancel the transfer and send a new one. To cancel a transfer, you need to fill out a written application in any form addressed to the head of the Sberbank office where the transfer was made.

How can I check the status of a transfer?

To clarify the status of the transfer, contact only the Sberbank office where the transfer was sent or another Sberbank office located.

How long is the international transfer “Hummingbird” stored in the Sberbank office?

An international transfer “Hummingbird” can be received or canceled within three years from the date of its sending.

How can I receive funds at the Sberbank office when transferring a large amount? Do I need to order them?

If you receive a large amount in rubles, as well as in foreign currency, we recommend that you first contact the Sberbank office to clarify the availability of the required amount and the possible timing of receipt.

Sberbank - KOLIBRI transfers

Hummingbird transfers within Ukraine, as well as between Ukraine, Russia, Kazakhstan and Belarus, will soon be stopped, as Sberbank of Russia is selling its subsidiary bank JSC Sberbank of Russia (Ukraine).In October 2016, a number of Russian payment systems (including Hummingbird) came under expanded sanctions from Ukraine; in response, on March 22, 2017, the State Duma, in the third reading, adopted changes to the federal law “On the National Payment System”, prohibiting cross-border money transfers from Russia to Ukraine using foreign payment systems. The law was signed by Putin.

Of all types of money transfers in Russia, urgent cash transfers “Hummingbird” of Sberbank of Russia are considered one of the youngest. This type of transfer appeared at the beginning of 2013, when Sberbank rebranded the Blitz money transfer system, popular among the population, which received a new life as urgent cash transfers Kolibri. The conditions for processing this urgent transfer have been significantly improved.

Hummingbird logo

So, KOLIBRI, these are urgent cash transfers from Sberbank of Russia, which are carried out both between Sberbank branches in Russia, and between Sberbank of Russia and its subsidiary banks abroad, as well as within one of the subsidiary banks. Transfers are made without opening an account (by both the sender and the recipient).

The system of urgent transfers "KOLIBRI" of Sberbank of Russia consists of several types of money transfers, namely:

- Transfers within Russia - urgent cash transfers between Sberbank branches throughout Russia.

- Transfers abroad - international urgent money transfers between Sberbank of Russia and its subsidiary banks abroad.

- Transfers within Ukraine - urgent cash transfers between branches of Sberbank of Russia JSC across the territory of Ukraine.

Banks participating in Kolibri transfers

The branch network of participants in the Kolibri transfer system consists of 4 banks:- OJSC "Sberbank of Russia" (Russian Federation)- with a branch network that ensures the receipt and issuance of transfers in more than 10,000 branches of the bank. Sberbank carries out transfers within Russia and transfers abroad. The list of branches of Sberbank of Russia that carry out Hummingbird money transfers can be viewed

- SB Sberbank JSC (Republic of Kazakhstan)- with 33 service units that carry out transfers with Russia (Almaty, Astana, Aktau, Aktobe, Taldykorgan, Atyrau, Karaganda, Pavlodar, Uralsk, Kostanay, Ust-Kamenogorsk). You can view the list of branches of SB Sberbank JSC that carry out international urgent money transfers “Kolibri”

- JSC "Sberbank of Russia" (Ukraine)- with 160 bank branches, which are present in all regions of Ukraine (Kiev region, Crimea, Dnepropetrovsk region, Donetsk region, etc.). The Bank carries out transfers both from Russia and across Ukraine (within its branch network). The list of branches of Sberbank of Russia JSC that carry out these transfers can be clarified

- OJSC "BPS-Sberbank" (Republic of Belarus)- with divisions in 46 cities of the republic (Minsk, Mogilev, Brest, Vitebsk, Gomel, etc.), which carry out transfers with Russia. The list of structural divisions of BPS-Sberbank can be viewed

On none of the websites of the banks listed above did I find information that using the Kolibri system you can process transfers between the subsidiary banks of Sberbank of Russia directly. That is, for example, transfers from Kazakhstan to Ukraine or from Ukraine directly to Belarus are not made and this is a big disadvantage of the system.

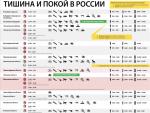

Conditions and commission for urgent money transfers KOLIBRI

The main conditions and commissions for KOLIBRI transfers, which operate in Sberbank of Russia and its subsidiary banks in 2013, can be divided into the following areas:

- Transfers within Russia

- Transfers abroad

- Transfers within Ukraine

- Conditions and tariffs for KOLIBRI transfers across Russia

Transfers within Russia are urgent cash transfers from Sberbank of Russia OJSC, which are carried out between the bank’s structural divisions and are carried out:

- Conditions and tariffs for KOLIBRI transfers abroad

№ Conditions/Participating countries OJSC "Sberbank of Russia" - from Russia SB Sberbank JSC - from Kazakhstan JSC "Sberbank of Russia" - from Ukraine OJSC "BPS-Sberbank" - from Belarus 1. Transfer currency KOLIBRI rubles, US dollars and euros rubles, US dollars and euros rubles, US dollars and euros rubles, US dollars and euros 2. Maximum amount of transfers per day - for residents no more than 5,000 US dollars (equivalent);

- for non-residents 10,000 (Ten thousand) US dollars

5000 US dollars (at the Bank of Russia exchange rate on the day of the transaction) 10,000 US dollars. 3. Bank commission for transfer - when sending a transfer to Kolibri 1% of the amount, but not less than 150 rubles. (5 US dollars/euro depending on the currency of transfer), max 3000 rubles, 100 US dollars/euro. 1% of the amount, min 150 Russian rubles; 1% of the amount, min 5 US dollars/5 euros 1% of the amount, min 150 Russian rubles; 1% of the amount, min 5 US dollars/5 euros 4. Bank commission for transfer - upon receipt of the Kolibri transfer 1% of the amount 1% of the amount 1% of the amount 1% of the amount 5. Deadline for money transfer no more than 1 hour from the moment of registration by the sender no more than 1 hour no more than 1 hour no more than 1 hour 6. Additional service (Recipient Notification) informing the recipient at the request of the sender by telephone about the fact of acceptance of the transfer in his favor - 10 rubles. 50 tenge No No 7. Cancellation of a transfer (until the recipient requests the transfer) 150 rub. 750 tenge 30 UAH 150 rub. - Conditions and tariffs for KOLIBRI transfers in Ukraine

How to send a transfer to Kolibri?

To make a transfer through a Sberbank branch, the sender will need:- Visit the Sberbank branch that provides Hummingbird transfers.

- Present an identification document.

- Provide the bank employee with the necessary information:

- Last name, first name and patronymic of the recipient of the money transfer;

- security question and answer for the recipient (if desired);

- your mobile phone number and/or the recipient's phone number (it is not necessary to indicate) - then the sender will be informed free of charge via SMS about the receipt of the transfer, and the recipient about the sending or cancellation of the transfer.

- Carefully check the application for transfer completed by the Sberbank operator and sign it.

- Deposit the transfer amount and the commission amount into the Bank's cash desk.

- Receive a receipt containing the transfer control number.

- Inform the recipient independently of the transfer control number.

How to get a translation of Kolibri?

To receive a Kolibri transfer, the recipient must do the following:- Visit any branch of Sberbank or a subsidiary bank that processes such transfers.

- Present a passport or other identification document.

- State the control number of the transfer and the answer to the security question (if specified) and the sender’s last name.

- Get a translation.

- For international transfers, you must also pay your part of the commission for receiving the transfer.

How to check the status of a transfer

It is not possible to check the status of the KOLIBRI transfer through the Sberbank website, since there is no such service.Instead, Sberbank invites the sender, and only if he wishes, to indicate in the application his mobile phone number and/or the phone number of the transfer recipient, i.e. This bank service is optional.

In this case:

- the sender will be informed free of charge via SMS about the receipt of the transfer,

- recipient - SMS message about sending or canceling the transfer.

How to correct mistakes made when completing a translation

Payment of the transfer is not made if the sender of the transfer, when filling out the “Application for Transfer”, indicated incorrect recipient information, i.e. when the recipient's full name and/or passport details do not match the data entered into the system as directed by the sender.In this case, the sender has the right to amend the data of the transfer recipient in terms of changing the surname, and/or first name, and/or patronymic of the recipient, upon presentation to the bank:

- receipt/receipt cash order 0402008 with the control number of the transfer, issued when processing the transfer.

- correctly indicate the transfer control number,

- and the data of the Identification Document of the sender of the transfer will coincide with his data (client data) specified in the transfer details when sending it.

- different spelling in the transfer details and details of the recipient’s identity document, the letters “E” or “E” and the letters “I” or “Y”,

- the same spelling of letters in Latin and Cyrillic. For example, “P” (Latin) and “P” (Cyr.).

- the absence or presence of a full name in the details - a space or a hyphen.

Canceling a bank transfer Kolibri

The sender has the right to cancel a transfer unclaimed by the recipient and return his money. True, the commission for processing the transfer is not refundable, in addition, the sender will additionally pay for the service of canceling the transfer.Cancellation of an unclaimed transfer is carried out in the structural unit of Sberbank of Russia / the Respondent that accepted the transfer, upon presentation of:

- identification document

- receipts with transfer control number.

- A written application is drawn up in any form addressed to the head of the branch of Sberbank of Russia OJSC / structural unit of the Respondent that accepted the transfer.

- The Bank checks the primary documents for the accepted transfer, after which it obtains permission from the head of the structural unit of the Respondent/structural unit/branch of Sberbank of Russia to pay out the money.

- The funds are paid to the sender.

Investment activity and investment process

Investment activity and investment process Why and how audits are carried out, or independent assessment as a factor in business efficiency

Why and how audits are carried out, or independent assessment as a factor in business efficiency Wage Fund Enterprise Wage Fund

Wage Fund Enterprise Wage Fund National Bank of Kazakhstan

National Bank of Kazakhstan