Presentation of the main sources of financing for the Unified State Examination business. Sources of financing for medium and small businesses. Consumer loan from a bank

The heads and managers of financial structures of current domestic enterprises are showing serious interest in selecting and finding ways and means to finance their business.

Banks and stock markets provide an opportunity to consider various proposals on this issue, explaining their features, correlating them with changes in the money market.

We invite you to consider the standard and most effective methods of obtaining capital for business development.

The source of finance for a businessman can be classified as both external and internal.

The first category includes those assets, monetary units that the organization receives “from the outside,” from companies from which the business is not directly dependent, for example, a bank, investors, investments. Which tool to use and direct is determined according to several main points:

- Price

- Passive, exactly its type

- Necessity and timing

Sources "from outside"

This type is divided into equity and debt. In the first case, the company uses its own funds, in the second, it takes out a loan. Investors believe that the latter financing instrument is more profitable, since the very cost of such an instrument already takes into account a small insurance amount, “at risk.” Business owners also see their benefits in this type of financing; in this situation, there is no need to allocate money to the lender in the organization.

The disadvantage of such an instrument is that it makes the company dependent on situations in the economic market; during a recession, for example, the organization may not be able to repay the loan.

Debt financing, types

- Syndicated loan

This form is used if one bank is unable to issue the requested amount of funds. Then the creditors form an association, and certain contractual relationships are drawn up both within the syndicate and with the loan recipient, which determine the algorithm of actions for repaying the loan.

According to statistics, our banking organizations use this method extremely rarely as a source of financing; Western companies use it more often.

An alternative to this method is bonds.

- Bonds

Issued by large companies in order to attract additional funds. Such papers can be freely available and can be easily purchased and sold. Sustainable enterprises that are able to make a forecast of the economic situation issue bonds denominated in foreign currency.

- Overdraft

In essence, this is a short-term loan. Overdraft is divided into classic, advance, and collection. A significant difference from a loan is that it is repaid in full, using funds written off from the card. The advantage of it is that to register it you do not need any additional documents other than your own bank plastic card with the limit on it. For this type of lending, it is enough that the movement of funds on the card is constant. The downside is high interest rates and a short period for repaying the loan.

- Leasing

Another form of lending is when the lessor leases some type of property for a long term with the option of either returning it or purchasing it. The advantages of leasing are that the profits of enterprises using leasing are subject to less tax. Leasing allows business owners to update their technical base. If, in a situation with a loan, you have an agreement that will prescribe clear terms and amounts of payments, then you can always agree with the lessor on terms that take into account your capabilities. Interest rates on leasing are usually several percent higher on the loan, however, despite this, the total benefits from this type of lending as leasing are greater than from a classic loan.

- Credit based on rating agency

In this case, the rating agency is the bank's guarantor and indicates whether the issuer can fulfill all its obligations. Based on their opinion, lenders and entrepreneurs decide which source of financing is most profitable and where demand is higher. With a positive assessment from the rating agency, the competitiveness of the enterprise increases.

- Secured loan

A secured loan must be secured by some valuable property that will ensure that the organization issuing the loan that you will definitely repay the amount of money issued. The property is sold only if the borrower fails to meet its debt obligations. The disadvantages are that such a loan requires more time to process and is associated with the risk of losing the pledged property. Plus - the interest rate is much lower compared to a classic loan.

Government lending

- Direct capital investments. These funds are directed to enterprises located in the public sector. Accordingly, all profits are state-owned.

- Subsidies. Allocation of small amounts, incomplete or partial financing. It covers both private and public companies. The positive feature of this type of financing is that it is interest-free, free and gratuitous.

- State order. The state acts as a buyer and forms an order for the production of a particular product to a specific company. An example is Russian Railways. The road is state-owned, and what moves along it is created by private organizations. In this case, the state does not spend money on production, and the manufacturer receives a profit from sales.

Equity financing, types

Raising funds through shares. Shares are issued by those organizations that have established themselves in the market and have stable cash flows. Shares may be offered initially, secondarily, partially or in full.

- Venture capital

Funds used for investment by an external investor through third parties in new, growing enterprises, or in those that are on the verge of bankruptcy. This type of investment involves high risk, but also income, the size of which is defined as “above average”. Through venture investments you can also acquire a share of the company in ownership.

- Syndicated investments

A united group of investors (who have the romantic name “business angels”), on their own initiative, invests in projects that they consider the most profitable. This method of receiving funds is also associated with the risk of lack of benefits (a business angel invests his own funds), but is practically free of bureaucratic delays.

Internal sources

Such funds are generated as a result of the operation of the enterprise. This includes: sales income, gross profit. This may include:

- Profit that is not distributed

These are funds that remain with the organization after it has paid all taxes and carried out all cash transactions on shares. Such money is sent to the company's assets and used for its further development and growth. Such funds can be allocated for the purchase of securities or simply stored in the feed of the cash balance.

- Automatic financing

Funds resulting from an increase in the size of the liability (increase in loan debt) when accruing (but withholding) wages to employees. Such funds are automatically distributed for the needs of the organization. This type comes with huge risks in the form of increasing the company's financial obligations.

- Factoring

Includes three parties: the factor (buyer of claims), debtor (buyer of goods) and creditor (supplier). In essence, this is speculation in short-term receivables, usually at a discount of 10 to 60 percent. A type of short-term loan secured by company assets.

- Capital optimization

It involves the creation of certain projects aimed at increasing or decreasing profitability. In this case, as a rule, comprehensive measures are taken that allow free funds to appear, which can be reinvested in other areas of the organization’s work, aimed at expanding it or creating new projects.

- Resetting a non-core asset

Assets that do not bring monetary benefits, on the contrary, distract funds and attention. In this case, the best solution is to sell such assets, and the proceeds must be transferred to the direction that the company considers a priority.

- Depreciation Fund

Depreciation is the wear and tear of production facilities, or rather, its monetary expression. The amount of money from which the fund is formed, aimed at these needs, is included in the cost of manufactured products, and accordingly affects the price. The main tools of the enterprise are repaired, replaced or rebuilt from these funds. The required amount of deduction is calculated from the original price of the asset for which depreciation is calculated. If equipment needs immediate repair or replacement, then the company can take the path of accelerated depreciation. In this case, deductions are made in a larger volume than the normative ones. This method is recommended only for large businesses, since when purchasing new equipment, volumes increase, the quantity of goods produced increases and depreciation is calculated on a larger number of products, and, therefore, prices do not rise.

When choosing sources of financing for business ideas, most entrepreneurs do not take into account that investments are necessary not only at the opening stage, but throughout the entire life cycle of the created enterprise. If you want the project to be successful and long-term, study ways to raise funds!

The concept of “business financing” and classification

This term means the supply (support) of entrepreneurial activity with financial resources. Depending on the place of origin of material resources, a distinction is made between internal and external financing.

At the initial stage of formation of the production process, managers use external resources, the origin of which is provided by the following sources:

- state ;

- banking organizations;

- shareholders;

- non-profit companies;

- partner companies;

- individuals.

When production begins to generate income, it becomes possible to attract internal resources, including:

- net profit;

- revenue of the future periods;

- (deductions for equipment);

- target reserves allocated to cover upcoming costs.

Ideally, an effective and profitable business is self-sustaining and does not require external costs. However, at first and during the period of expansion of the scope of activity, it is difficult to do without external types of financing - further on each of them in detail.

Main sources of business financing in comparison

A common practice among business entities is to attract borrowed money. To maintain the right to fully manage their own business, most entrepreneurs take out loans, credits, and borrowings.

A common practice among business entities is to attract borrowed money. To maintain the right to fully manage their own business, most entrepreneurs take out loans, credits, and borrowings.

Bank lending

Loans from banks occupy a leading position among the methods of financing small businesses, covering an expanded range of costs: industrial, consumer, agricultural, mortgage loans.

pros:

- prompt decision on extradition;

- independent distribution of funds without control and instructions from the investor.

Minuses:

- short period of use (standard - 36 months);

- the need to provide collateral; obligatory payment of interest and insurance premiums.

Leasing programs

Leasing is a complex form of financial lending based on the provision of fixed assets for rent with subsequent purchase.

The subject of leasing can be enterprises, land plots, vehicles, equipment, property (movable and immovable).

pros:

- financing is calculated in 100% proportion to the cost of the equipment - for comparison, banks require 10–15% of the price;

- there is no requirement to provide collateral - this is the rented (purchased) equipment (site, transport);

- the debt on the organization's balance sheet does not increase;

- more favorable conditions compared to a bank loan;

- All payments by the lessee are included in the costs of the enterprise.

Minuses:

- When applying for leasing, an initial payment may be required - up to 30% of the value of the property;

- Not all leasing lending schemes are suitable for entrepreneurs working under a simplified taxation system - you should carefully select a company for cooperation;

- VAT is charged on the leasing amount.

Trade loan

Form of mutual settlements between companies. You can order the necessary goods (equipment) with deferred payment. This method is often used by entrepreneurs whose activity is the sale of products from another manufacturer: they take a wholesale batch of goods for purchase, and the payment is made after its sale in the retail network.

A way of mutually beneficial cooperation between firms of different directions is also possible - the ordered product (service) is paid for in kind - by what another enterprise produces.

Government subsidies, tax breaks

Beginning entrepreneurs receive government assistance in organizing a business. One of the means of such assistance is subsidies. These are one-time payments from the state, local governments or international organizations to cover part of the costs, capital costs or contributions.

In addition, the tax system provides special conditions for individual entrepreneurs (IP), regulated by Federal Law No. 477-F3.

The following individual entrepreneurs can obtain the right to a tax holiday (zero tax rate) in 2016:

- registered for the first time;

- those who have chosen one of the taxation schemes - simplified (STS) or patent (PSN);

- conducting activities in the social, industrial or scientific sectors.

Holidays are not established throughout Russia; in each region they are established by local authorities at their own discretion. The benefit is also valid in 2020. Please note that it is designed for two tax periods (years) for each specific individual entrepreneur.

Still, no matter how good and promising the idea may look, minimize expenses and rely on your own resources, remembering the notorious saying: “You take someone else’s, but give back your own!”

Grants and other sources of project financing

The most attractive form of financing for small businesses is undoubtedly a free targeted subsidy for scientific research, training, treatment and the implementation of social projects. However, in order for a government or commercial grant to go to you, the idea must meet the following criteria:

The most attractive form of financing for small businesses is undoubtedly a free targeted subsidy for scientific research, training, treatment and the implementation of social projects. However, in order for a government or commercial grant to go to you, the idea must meet the following criteria:

- presenting an evidentiary justification for the importance of the project;

- quick payback - grants are issued for a short period (from several months to a year);

- a clearly developed plan for the implementation of the business idea, indicating the time frame for achieving the set goals;

- willingness to bear a certain part of the costs;

- a report for every penny spent from the allocated funds.

Although government grants are more designed to support scientists and young professionals, funds from the budget are annually allocated to subsidize small forms of property in Russia.

In parallel, they are being developed at the state and regional levels - information about existing projects is presented in territorial employment centers and on the official website of the Ministry of Finance.

Foreign investors are also looking for promising representatives of small businesses and are ready to invest impressive sums in the development of interesting projects. However, keep in mind that such “donors” often demand in return a share of ownership or a large percentage of profits, and also set a condition for officially securing authorship of the idea.

If you cannot do without attracting additional investments, once again make sure that the decision you made is correct, calculate all the possible risks and set yourself a time frame for repaying the loan that you will definitely meet!

Sources of business financing

Financing- This is a way to provide entrepreneurship with cash.

Enterprise finance– the sum of the company’s external and internal funds that are in its full use.

Sources of financing– ways to obtain funds and a list of entities that can provide them. Sources of business financing can be external and internal.

There are two types of financing:

– Internal financing;

– External financing;

Internal sources contain finances that were accumulated during the operation of the enterprise, initial capital, and other investments of legal entities. These funds are used to purchase raw materials, wages for enterprise employees, energy resources and everything that is needed to produce goods and services.

For the full operation of the enterprise, own funds are sometimes not enough. The reasons for this may be inflation, debt repayment periods, enterprise growth, and the creation of subsidiaries. In these situations, the enterprise is forced to turn to external sources of financing.

A loan issued by a banking institution is one of the main sources of external financing for an enterprise. Foreign banking institutions offer lower interest rates and loan repayment options. They are serious competitors to Russian banks.

Securities are also a way of externally financing an organization.

Positive aspects of internal sources of financing:

1) there are no additional interest payments;

2) an easy scheme for raising funds.

Negative aspects of internal sources of financing:

1) limited amount of funds;

2) no increase in funds for invested funds due to loans.

Positive aspects of external sources of financing:

1) unlimited amount of money received;

2) increasing profits.

Negative aspects of external sources of financing:

1) unstable financial situation;

2) high risk of bankruptcy;

3) interest payments contribute to a decrease in the overall profit of the enterprise.

Borisova Arina Sergeevna, I-11-1

No enterprise can exist without financial investments. It doesn’t matter whether a business project is at the beginning of implementation or has already existed for several years, its owner faces a difficult task - to constantly search and find sources of business financing.

Main types of business financing sources

Finance is the total amount of funds that ensure all the activities of the company: from solvency to suppliers and lessors in the present to the possibility of expanding the scope of interests in the future.

Unfortunately, from time to time they may reasons arise that impede the smooth and uninterrupted operation of the enterprise. Among them may be:

- funds from the sale of products arrive later than the time comes to pay off debt obligations,

- inflation depreciates the income received so that it is impossible to purchase raw materials for the production of the next batch of goods,

- expansion of the company or opening of a branch.

In all of the above situations, the company has to look for internal and external sources of financing.

Source of financing is a donor resource that provides a permanent or temporary influx of material and intangible funds. The more stable a company's business is, the higher its liquidity in the economic market, so the main headache for an entrepreneur is finding the best source of financing.

Types of funding sources:

- interior,

- external,

- mixed.

Financial analysts insist on the idea that primary sources must be rooted in several different resources because each of them has its own characteristics.

Internal sources

Internal sources of financing are the totality of all the organization’s own tangible and intangible resources that were received as a result of the company’s work. They are expressed not only in money, but also in intellectual, technical and innovative resources.

Internal sources of business financing include:

- income in cash equivalent,

- depreciation deductions,

- issued loans,

- withholding wages,

- factoring,

- sale of assets,

- reserve profit,

- redistribution of funds.

Income in money

Profit from the sale of goods or services belongs to the owners of the company. Some of them are paid as legal dividends to the founders, and some go to ensure the functioning of the company in the future (purchases of raw materials, payment of labor, utility bills and taxes). Perfectly suitable as a source.

Depreciation deductions

This is the name of a certain amount set aside in reserve in case of breakdown or wear and tear of equipment. It should be enough to buy new equipment without the risk of getting into other sources and assets. They can be used as an investment in a new idea.

Internal sources of business financing

Loans issued

Those funds that were issued to clients on a credit basis. If necessary, they can be claimed.

Salary deduction

The employee has the right to receive payment for the work done. However, if you need to invest additionally in a new project, You can refrain from paying for a month or two, having previously agreed with the staff. This method is fraught with great risk, as it increases the company's debt and provokes workers to strike.

Factoring

The ability to defer payments to the supplier company by promising to pay everything with interest later.

Sale of assets

An asset is any tangible or intangible resource that has its own price. If an enterprise or its participants have unused assets, such as land or warehouse space, then they can be sold and the proceeds invested in a new, promising project.

Reserve profit

Money that is set aside in reserve in case of unexpected expenses or to eliminate the consequences of force majeure and natural disasters.

Redistribution of funds

It will help if the organization is simultaneously engaged in several areas. It is necessary to determine the most productive and transfer finances to it from other, less effective ones.

Internal financing is preferable, since it does not imply outside interference with the subsequent partial or even complete loss of main control over the activities of the enterprise.

External sources

External sources of financing are the use of financial resources received from outside to continue the company's activities.

Depending on the type and duration, external financing can be attracted (from investors and the state) and borrowed (credit firms, individuals and legal entities).

Examples of external sources of financing:

- loans,

- leasing,

- overdraft,

- bonds,

- trade loans,

- equity financing,

- merger with another organization,

- sale of shares,

- state sponsorship.

Types of external sources of business financing

Loans

A loan is the most common way to get money for development, because you can not only get it quickly, but also choose the most appropriate program. In addition, lending is available to most business owners.

There are two main types of loans:

- commercial (provided by the supplier company in the form of deferred payment),

- financial (actually a cash loan from financial organizations).

The loan is issued against the working capital or property of the company. Its amount cannot exceed 1 billion rubles, which the company must return within 3 years.

Leasing

Leasing is considered one of the types of lending. It differs from a regular loan in that an organization can lease machinery or equipment and, carrying out its activities with their help, gradually pay the full amount to the legal owner. In other words, this is a full installment plan.

By leasing it is possible to rent:

- the whole enterprise

- plot of land

- construction,

- transport,

- technology,

- real estate.

As a rule, leasing companies accommodate and provide the most favorable conditions to the borrower: they do not require collateral, do not charge interest, and draw up an individual payment schedule.

Registration of leasing is much faster than a loan due to the absence of the need to provide a large number of documents.

Overdraft

An overdraft is a form of bank lending when the company's main account is linked to a credit account. The maximum amount is 50% of the monthly cash turnover of the company itself.

Thus, the bank becomes an invisible financial partner, which is always aware of the commercial situation: if an organization needs investments for any needs, funds from the bank are automatically transferred to its account. However, if by the end of the agreed period the money issued is not returned to the banking institution, interest will be charged.

Bonds

Bonds mean a loan with an interest rate issued by an investor.

In terms of time, there can be long-term (from 7 years), medium-term (up to 7 years) and short-term (up to 2 years) bonds.

There are two bond options:

- coupon (the loan is paid with an equal percentage breakdown for 2, 3 or 4 times during the year),

- discount (the loan is repaid several times during the year, but the interest rate may vary from time to time).

Trade loans

This method of external financing is suitable if enterprises cooperating with each other agree to receive payment in kind, goods or services, that is exchange the product of production.

Leasing as a form of external financing

Equity financing

Such a source implies involvement of a new member, investor in the founders, who, by investing his funds in the authorized capital, will expand or stabilize the financial capabilities of the company.

Merger

If necessary, you can find another company with the same financing problems and merge the companies. With economies of scale, partner organizations can find a more profitable source. How? To take out the same loan, the company must be licensed, and the larger it is, the more likely it is that the procedure for obtaining a license will be successful.

Sale of shares

By selling even a small number of company shares, you can significantly replenish your budget. There is also a chance that large capitalists who are ready to invest in production will become interested in the company. But you need to be prepared to share control: the greater the flow of investment from outside, the larger piece of the share will need to be shared.

Government sponsorship

A separate type of external financing. Unlike a bank loan, government sponsorship involves a free and irrevocable loan of money. However, it is not so easy to obtain it, because you need to meet one important criterion - it falls within the sphere of interests of government bodies.

There are several types of government funding:

- capital investments (if on a permanent basis, then the state receives a controlling stake),

- subsidies (partial sponsorship),

- orders (the state orders and buys products, providing the company with 100% sales of goods).

External financing is associated with great risks, and it is better to resort to it in cases where you cannot cope with the crisis in the company on your own.

Pros and cons of internal and external sources of financing

| Source | pros | Minuses |

| Interior |

– ease of raising finance, – no need to ask for permission to spend, – no need to pay interest rates, – maintaining control over activities; |

– limited amount of finance, – restrictions on expansion. |

| External |

– unlimited financial flow, – possibility of changing equipment, – increase in turnover and, accordingly, profit; |

– high risk of bankruptcy, – the need to pay interest rates, – the need to go through bureaucratic red tape. |

How to choose a funding source

The efficiency and profit of the entire organization as a whole depends on the correct choice of source of financing. First of all, a businessman should check his actions with the following list:

- Give precise answers to the following questions: why is financing needed? how much money will you need? When will the company be able to return them?

- Decide on a list of potential sources of collateral.

- Starting with the cheapest and ending with the most expensive, create a hierarchy.

- Calculate the costs and payback of the business idea for which sources are being searched.

- Choose the most optimal financing option.

It is possible to understand to what extent the choice of a funding source was justified only by the results of the work, after a while: if the productivity and turnover of the organization increased, then everything was done correctly.

Social science. A complete course of preparation for the Unified State Exam Shemakhanova Irina Albertovna

2.7. Main sources of business financing

Financing – a way to provide entrepreneurship with cash. Internal sources of financing– sources of cash flows that are generated from the results of business activities. This could be an investment by the company's founders in the authorized capital; cash received after the sale of company shares, the sale of company property, receipt of rent for leasing property, income from the sale of products.

1) Profit (gross) - the difference between its income and costs or production costs, i.e. the total profit received before all deductions and deductions are made. Net income (residual income)- this is the difference between the amount of sales revenue and all the costs of the enterprise.

2) Depreciation – depreciation of fixed assets calculated in monetary terms in the process of their application and production use. The instrument for compensating for the depreciation of fixed assets is depreciation charges in the form of money allocated for repairs or construction, or the production of new fixed assets. The amount of depreciation charges is included in the production costs (cost price) of products and thereby passes into the price.

External sources of funding

1) debt financing – borrowed capital (short-term loans and borrowings; long-term loans).

– Loan capital represents an independent part of economic capital, which operates in the form of cash in the field of entrepreneurial activity.

– Mortgage loan- mortgage loan. This loan is the most common form of secured loan. Its essence is that when a company receives debt funds, it guarantees the creditor to repay the debt, including interest.

– Trade credit is a commercial loan, consists in the fact that an entrepreneur buys a product by deferring its payment.

– Stock are a common form of raising funds. By issuing and selling shares, a business firm receives a debt loan from the buyer, as a result of which the shareholder acquires the right to the property of the company, as well as to receive dividends. Dividends in this case are interest on the loan, which is represented in the form of money paid for the shares.

2) Transformation of an individual enterprise into a partnership.

3) Transformation of the partnership into a closed joint-stock company.

4) Using funds from various funds to support small businesses.

5) Gratuitous financing is the representation of funds in the form of free charitable donations, assistance, and subsidies.

Sale of shares is also a way to attract finance from outside, and this is a very important source of financing, since a company can have hundreds and thousands of shareholders.

State budget financing:

– The state allocates funds to public sector enterprises in the form of direct capital investments. Public sector enterprises are owned by the government. This means that the state also owns the profits from their activities.

– The state can also provide firms with its funds in the form of subsidies. This is partial financing of the activities of companies. Subsidies can be given to both public and private firms. The main difference between government financing and a bank loan is that the company receives funds from the government free of charge and irrevocably.

– State order: the state orders a company to manufacture a particular product and declares itself to be its buyer. The state here does not finance costs, but provides the company with income from the sale of goods in advance.

This text is an introductory fragment. From the book All the Caucasian Wars of Russia. The most complete encyclopedia author Runov Valentin Alexandrovich From the book 20th century Encyclopedia of Inventions author Rylev Yuri IosifovichMain sources used Aviation: Encyclopedia / Ch. ed. G.P. Svishchev. - M.: Great Russian Encyclopedia, 1994. Bernatosyan S.G. Records of nature and human activity. - Mn.: Askar, 1994. Biographical dictionary of figures in natural science and technology: in 2 volumes / Rep. ed.

From the book Russian Doctrine author Kalashnikov Maxim4. Sources of financing for strategic programs of education, science and technology The significant cost and capital intensity of a number of strategic directions of scientific and technological development presupposes targeted financing from special funds, filling and

author Bashilov Boris EvgenievichChapter 2. Funding needs and sources

From the book Organizing and running a business in the field of trade and services author Bashilov Boris Evgenievich2.2. Sources of financing... Sources of financing can be own and attracted (borrowed). As can be seen from the above example, equity capital (contributions of founders) will be used as own sources of financing. At the same

From the book Economics of Real Estate author Burkhanova Natalya8. Participants in the real estate financing process Participants in the real estate financing process include local and federal government authorities, financial institutions, investors, etc. Economic and legal relations that are created between

From the book by Oscar Wilde. Aphorisms by Wilde OscarMain sources Parandovsky Ya. Alchemy of the word; Petrarch; King of words. – M., 1990. Wilde O. Aphorisms and paradoxes. – N. Novgorod, 1999. Wilde O. Favorites. - M., 1989. Wilde O. Selected works in 2 volumes - M., 1960.-T.1-2. Wilde O. Selected works in 2 volumes - M., 1993.-T. 2. Wilde O.

From the book by George Bernard Shaw. Aphorisms by Shaw BernardPRIMARY SOURCES Shaw J.B. Autobiographical Notes; Articles; Letters. – M., 1989. Shaw J.B. Thoughts and fragments. – M., 1931. Shaw J.B. About drama and theater. – M., 1963. Shaw J.B. About music and musicians. – M., 1965. Shaw J.B. Letters. – M., 1971. Show J.B. Complete. collection plays in 6 volumes - L., 1978 - 1980. - T.1 -

From the book The Big Book of Aphorisms authorMain sources 1. In Russian Allen. Judgments // Foreign literature. - M., 1988. - No. 11. Amiel A. From the diary. - St. Petersburg, 1901. Aphorisms: According to foreign sources. - M., 1985. Babichev N., Borovsky Ya. Dictionary of Latin winged words. - M., 1988. Babkin A. M., Shendetsov V. V. Dictionary

From the book Guide to Life: Unwritten laws, unexpected advice, good phrases made in USA author Dushenko Konstantin VasilievichPrimary sources 21st Century Dictionary of Quotations. – New York, 1993.Bloch A. Murphy’s Law 2000. – New York, 1999.Bloch A. Murphy’s Law, and Other Reasons why Things Go Wrong. – Los Angeles, 1980. Boone L. E. Quotable Business. – New York, 1999. Brilliant A. Appreciate Me Now and Avoid the Rush. – Santa Barbara, 1981. Byrne R. 1,911 Best Things Anybody Ever Said. – New York, 1988. Cohen J. M. and M. J. The Penguin Dictionary of Twentieth-Century

From the book Thoughts, aphorisms and jokes of famous men author Dushenko Konstantin VasilievichMAIN SOURCES 1. In Russian by Peter Abelar. The story of my disasters. - M., 1994. Aphorisms: According to foreign sources. - M., 1985. Balzac O. Physiology of marriage. - M., 1995. Bogoslovsky N. Notes on the brim of a hat and something else. - M., 1997. Borohov E. Encyclopedia of aphorisms. - M.,

From the book Thoughts, aphorisms and jokes of outstanding women author Dushenko Konstantin VasilievichMAIN SOURCES Abelar P. History of my disasters. – M., 1994. Svetlana Alexievich: A moment of love as a moment of truth / The conversation was conducted by Y. Yuferova // Person. – M., 2000. – No. 4. Irina Alferova: “The new time needs a new female perspective” / The conversation was conducted by S. Yagodovskaya. // Your leisure time. – M., 1999. –

From the book Thoughts and Aphorisms by Heine HeinrichMain sources Heine G. Collection. op. in 10 volumes - M., 1956 - 1959. Heine G. Collection. op. in 6 volumes - M., 1980-1983. Heine G. Selected Thoughts. – St. Petersburg, 1884. Heine in the memoirs of his contemporaries. – M., 1988. Gizhdeu S. Heinrich Heine. – M., 1964. Tynyanov Yu. Tyutchev and Heine // Tynyanov Yu. Poetics. Story

From the book Enterprise Planning: Cheat Sheet author author unknown58. MAIN TYPES OF PROGRAMS FOR BUSINESS DEVELOPMENT PLANNING In some cases, when a full-fledged business plan is not required, but only a feasibility study is sufficient, you can use the ROFER product Business Plan M or similar programs for calculating and writing a feasibility study. Systems for

From the book The Big Book of Wisdom author Dushenko Konstantin VasilievichMain sources 1. In Russian Allen. Judgments // Foreign literature. – M., 1988. – No. 11. Amiel A. From the diary. – St. Petersburg, 1901. Aphorisms: According to foreign sources. – M., 1985. Babichev N., Borovsky Ya. Dictionary of Latin winged words. – M., 1988. Babkin A. M., Shendetsov V. V.

From the book Thoughts, aphorisms, quotes. Business, career, management author Dushenko Konstantin VasilievichMain sources 1. In RussianAphorisms: Based on foreign sources. – M., 1985. Beighton A. et al. 25 key books on economics: Analysis and comments. – Chelyabinsk, 1999. Business and manager. – M., 1992. Beers A. “Dictionary of Satan” and stories. – M., 1966. Boyett J. G., Boyett J. T.

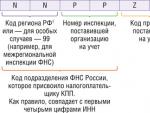

OJSC "South Ural Housing Construction and Mortgage Corporation" (JSC "yuu kzhsi") OJSC kzhsi

OJSC "South Ural Housing Construction and Mortgage Corporation" (JSC "yuu kzhsi") OJSC kzhsi Kbk vat for legal entities. Kbk for payment of VAT. KBK VAT: tax agent

Kbk vat for legal entities. Kbk for payment of VAT. KBK VAT: tax agent Accounting info 1s bp disable control of negative balances off-balance sheet

Accounting info 1s bp disable control of negative balances off-balance sheet Correctly calculate the allowance up to 1

Correctly calculate the allowance up to 1